Frequently Asked Questions

The Campaign

Preferred Shares

Owner Loans

Donations

The Project

The Campaign

Preferred Shares

Owner Loans

Donations

The Project

Hudson Grocery Co-op’s Community Investment Campaign is a capital campaign. Capital in the business world is property or assets, something that is owned. A capital campaign is an effort by an organization to raise significant dollars in a specified period of time to fund a one-time need—in our case, funding the purchase, inventory, rebranding, renovation, and initial operating costs of our community-owned store.

Co-ops, because of their unique legal structure, have the ability to raise capital from owners through loans, preferred share sales, and donations. On average, food co-ops raise at least 50% of the capital required to open their doors from owners. Capital raised from owners is cheaper than bank financing, more flexible, and allows owners the opportunity to exercise the cooperative principle of Economic Participation. Hudson Grocery Co-op owners have the opportunity to make a loan, purchase preferred shares, or make a charitable gift.

Your Ownership is the terrific first step that gives you the right to vote for Board members and to run for the Board, giving you input into how the store is governed. And now, as an Owner, you have another exclusive opportunity: to invest further in your store, in your community, and in your values, with the potential to earn a fair rate of return. Owner Loans and Preferred Shares are long-standing mechanisms used by grocery co-ops across the country to raise the money needed to open a store. Loans and Preferred Shares demonstrate a loyal customer base and reduce debt service, making the co-op stronger. Donations to the co-op further strengthen our financial position because they do not require interest or dividend payments.

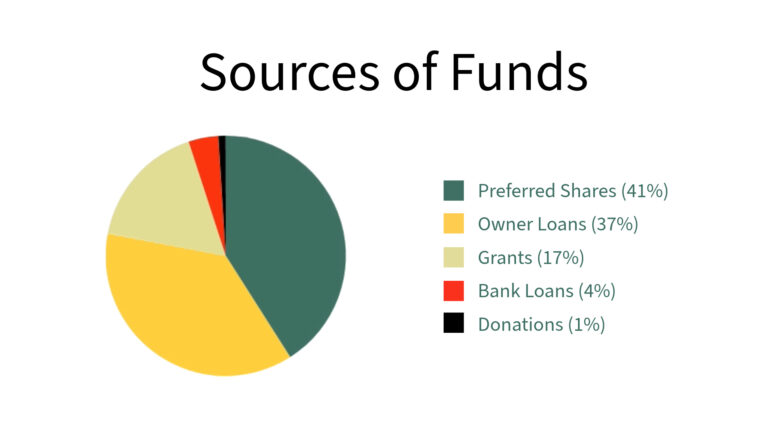

$2.16 million is needed by March 15, 2024 to put the Hudson Grocery Co-op on a solid financial footing. This will allow us to upgrade our equipment and technology in store as well as complete a store remodel to modernize the store and make it our own.

Investments in preferred shares and loans along with donations will fund the purchase of the assets of Fresh and Natural Foods, necessary renovations, rebranding of the store, technology updates, stock the shelves, and ensure that the store has adequate operating capital.

Our Investor Packet includes detailed information about the uses of funds raised through the capital campaign. Please email us at invest@hudsongrocerycoop.org to request a copy.

Our community investment campaign ends March 15, 2024.

Co-op owners have the opportunity to purchase preferred shares, make an interest-earning loan to the co-op or a tax-deductible eligible donation. The opportunity to purchase preferred shares or make an interest-earning loan to the co-op is available to co-op owners who reside in Wisconsin or Minnesota. The opportunity to make a tax-deductible eligible donation is available to anyone, whether they are an owner or not.

Eligible owners have the opportunity to purchase preferred shares AND make a loan.

Please email us at invest@hudsongrocerycoop.org to request an investor packet.

The option to purchase preferred shares, make a loan, or give a donation allows every owner the opportunity to participate in a meaningful way!

Purchase Preferred Shares, then, if you can invest more, consider a loan in addition to your shares. Selecting low or zero interest on your loan is also extremely beneficial to the co-op. Optionally, a donation skips the paperwork and is another great way to support the co-op.

As with any investment in a business, there are risks to your investment and you are required to read our investment documents prior to investing. Please email us at invest@hudsongrocerycoop.org to request a copy.

Once you have read the investment documents, please complete a pledge form. Email us at invest@hudsongrocerycoop.org if you have any questions.

Businesses who own shares in the co-op can make a loan in the name of the business. Any business who wants to support the capital campaign can make a donation through our fiscal sponsor, Sustain Hudson.

The campaign will wrap up on March 15, 2024. The sooner we reach our goal of $2.16 million the sooner we execute the work needed to transform Fresh and Natural to the Hudson Grocery Co-op.

Preferred Shares are non-voting stock that could yield annual dividends. Any Owner who lives in Wisconsin or Minnesota can participate and buy Preferred Shares at $500 per share. Outside of donations, Preferred Shares are the most co-op friendly way to invest, because they show up as equity (not debt) on the co-op’s financial statement. They should be considered a long-term investment (15+ years). They can yield annual dividends but like most stock investments, there is risk and no guarantees.

Dividend distributions on the Preferred Shares will be made at the Board’s sole discretion. Shares have a target dividend rate of 2.5% to 5.0%. However, in any given year the Board, in its discretion, may choose not to distribute a dividend, based on the financial performance of the co-op that year.

The Shares may not be sold to third parties. Instead, they may only be sold back to the co-op, subject to the Board’s approval. The co-op does not plan to redeem Shares before it becomes profitable and all loans are repaid. Preferred Shares are a long-term investment.

When you make a pledge to purchase preferred shares you’ll receive legal documents to complete and sign. Once those documents are signed you’ll receive an email invoice. Using that invoice you can mail your check made out to Hudson Grocery Co-op, PO Box 92, Hudson, WI 54016 referencing the invoice number. Once we receive funds, you’ll receive a Notice of Shares certificate.

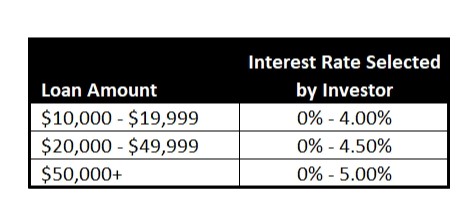

In short, owner loans are the co-op borrowing money from YOU (our owners) instead of borrowing money from the bank. Loans are a 15-year investment with interest rates up to 5% based on the amount of the loan. Loans are available only to Hudson Grocery Co-op Owners living in Wisconsin or Minnesota who want to make a large investment, $10,000.00 or more. Loan interest payments begin in year 6 of the loan and principal plus interest payments begin in year 11 of the loan.

The opportunity to make an interest-earning loan to the co-op is available to co-op owners who reside in Wisconsin or Minnesota. The following are selected highlights of the loan terms. Please see our Investor Packet for a sample loan agreement containing the full loan terms. Please email us at invest@hudsongrocerycoop.org to request a copy.

Interest rates range from 0-5%, based on the size of the loan. Some owners may choose to lend at 0% interest rate, which results in significant cost savings for the co-op!

Simple interest based on the amount of your loan accrues on the principal amount from the date the funds are made available to the cooperative.

You should not expect to get the money back early. You can contact the Board if you have extreme circumstances. Any early return is at the Board’s discretion.

As with any loan, there are risks to lending to the Hudson Grocery Co-op. It is important that you read the Investor Packet and understand the risks involved with a loan.

Nationally, a food co-op’s success rate after five years is 79%. (This compares with a typical retail success rate of 47% after five years.) The Hudson Grocery Co-op Board of Directors has studied the factors that contribute to co-op success and sought the advice of legal and industry experts to help limit risk. It’s always a good idea to consult your financial planner or accountant before investing.

Owner loans are legal in the states of Wisconsin and Minnesota. We have contracted with an attorney specializing in co-op law to prepare the loan paperwork.

No problem. As long as your primary residency is in Wisconsin or Minnesota when the loan is made and you provide the co-op with your updated address, we will continue to communicate with you at your new home making sure you get up-to-date information about your loan after your move.

We encourage you to keep loan documents with your estate so your family members are aware of the loan. We encourage you to consult with your estate planning adviser. A successor to the lender may assume the rights and obligations of the lender through the ordinary settlement of the lender’s estate.

First, read the Investor Packet carefully. It contains a sample of the loan agreement that you and the co-op will sign electronically. It contains a sample of the promissory note the co-op will sign. It also contains our required disclosures of the risks of this investment and financial projections. After reviewing, submit your pledge online, contact 715-330-3025 or email invest@hudsongrocerycoop.org and one of our friendly volunteers will confirm details for your loan agreement (your name, co-signer if desired, and rate amount). We will then prepare your customized loan agreement and send that to you for your signature via an electronic form.

No, you cannot fund your loan with a credit card. Personal checks, cashier checks, and money orders are all great options for loaning the co-op money.

You can make a donation eligible for a tax deduction in any amount to our fiscal sponsor, Sustain Hudson.

Please see our Pledge Form for options. Donations made through Sustain Hudson, our fiscal sponsor, are eligible for a tax deduction and 100% of your donation will be given to Hudson Grocery Co-op. Once you complete the pledge form you’ll be instructed to mail your check made out to Sustain Hudson to PO Box 92, Hudson, WI 54016. Check with your financial advisor or accountant for details on how making a charitable donation may affect your individual tax situation. Please contact us at invest@hudsongrocerycoop.org or call 715-330-3025 with any questions.

We ask that you submit your donation within five business days after you make your pledge. If you need more time please contact us at invest@hudsongrocerycoop.org or call 715-330-3025.

Absolutely! If your employer has a charitable donation match program, that’s a terrific way to double or triple your impact. Check with your employer to see if a donation to our campaign qualifies for a match.

Yes. Site evaluations and sales forecast analysis were performed by G2G Research group in 2015 and 2022. The result is a successful business projection. More in-depth information from these evaluations can be found in our business plan, available upon request. Please email us at invest@hudsongrocerycoop.org to request a copy.

In 2023, Hudson Grocery Co-op purchased the assets of Fresh and Natural Foods located at 1701 Ward Avenue in Hudson, WI. We have negotiated a multi-year lease with the landlord. We anticipate rebranding of the Fresh and Natural Foods store will take several months. A grand opening of your community-owned Hudson Grocery Co-op store is planned for spring 2024.

The opportunity to purchase the assets of Fresh and Natural Foods was presented to the HGC Board of Directors. After completing sales forecasts and a 10-year financial plan and other in-depth due diligence, the Board determined that transforming Fresh and Natural Foods into the Hudson Grocery Co-op is our best and most cost effective option to open a cooperative store on an expedited timeline. The cost of the Fresh and Natural Foods acquisition and updates is less than half of what it would be to open our store at other locations we pursued.

We honor and acknowledge the vision of the original organizers of the co-op to have a store location in downtown Hudson. To be successful, we know that we need a location with ample parking, affordable rent, favorable store traffic and sales projections, and adequate square footage. Our market studies evaluated locations in downtown Hudson, North Hudson, and “the hill”. A downtown location is challenged by parking, reduced square footage, and significantly lower long-term sales projections. A location on “the hill’ offers the best opportunity for the co-op to be successful and viable in the long-term.

The co-op will be a full-service cooperative grocery store and will serve the greater St Croix Valley.

The store will be stocked with healthy and sustainable items, emphasizing locally sourced produce and goods. The co-op will offer fresh vegetables and fruits, bulk goods, meats, household products, wellness products, frozen foods, and grab-n-go items. Our goal from the beginning was to build a conscious and nurturing marketplace, and cultivate a sustainable community through goods, education, and outreach and this location allows us to do just that

Yes, a professional market study produced a solid sales forecast that was used to create financial projections with the assistance of Columinate, a nationally recognized cooperative consulting firm. The result is a successful business projection that includes sales of over $4 million in our first year of operation and up to $6 million by year 5 of operation. Nationally, a food co-op’s success rate after five years is 79%. (This compares with a typical retail success rate of 47% after five years.) In addition, the HGC Board of Directors has studied the factors that contribute to co-op success and have sought the advice of legal and industry experts.

This business model will support the local economy—one of the Co-op market’s core values—from the jobs created to the local farmers who can expand operations. Your dollars will stay right here in the St Croix Valley—something to feel GOOD about!

Your Hudson Grocery Co-op will:

Yes! Those who are not Hudson Grocery Co-op owners can still shop the fresh, local produce, prepared food, wellness products, and other items that will be offered at the co-op. You might consider becoming an owner and enjoy the many benefits of being an owner including access to member only-sales and profit sharing dividends.

The Hudson Grocery Co-op is owned collectively by owners who elect a board of directors to represent their interests. Therefore, members have a voice in the operations of the store, the products it carries, and the way the store is run. As an owner, you may receive patronage dividends when the Co-op makes a profit. With its focus on community, the co-op supports educational programs and community events, thereby increasing the overall demand for local, healthy, organic, sustainable foods and other grocery products. As a co-op owner, you will have access to exclusive specials or discounts on certain products or services.

Becoming an owner is easy! It’s a one-time investment of $80.

Visit our online application and become an owner today! You may also print a paper application and mail it to us with your payment.

Thanks for asking! There are a number of ways that you can help:

Contact us with any additional questions or suggestions! You can reach us at 715-330-3025 or info@hudsongrocerycoop.org.